Key Findings:

- Performing a competitor analysis to identify the differences between companies' customer feedback allows organisations to quantify the business improvements that can be made from customer feedback.

- Discovering common issues that cause customer churn will help improve business performance through retention and drive advocacy in public reviews.

Introduction:

Throughout our investigations into the public review feedback for 10 major insurance providers across the UK, we have been able to quantify how the VoC Life Cycle Framework can help your business uncover complex bottlenecks in your claims operation and lead to improvements while boosting customer satisfaction. When an insurance company looks to improve the claims process, especially in the insurance industry, it's crucial to discover what causes customers to churn. The claim process is a high-touch interaction that can leave a lasting impression about how customers feel about your business, which is why negative experiences can impact the company. Today, we’ll delve deeper into the reasons why LV= has a higher claims score than Hastings Direct, and how Hastings Direct can use this information to improve their score, reduce customer churn and create customer advocacy.

For more detail on the Insurance Customer Life Cycle, you may wish to read the Hastings Direct Insurance Case Study.

Competitor analysis informs business decisions and reveals opportunities

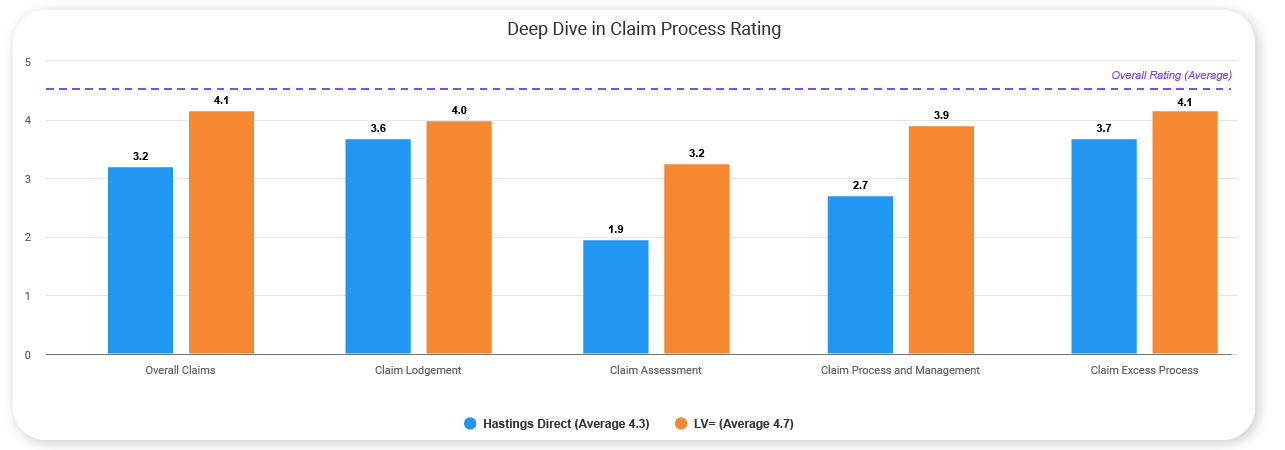

Using Touchpoint Group’s AI Customer Analytics Tool, you are able to look at the whole picture by benchmarking your company against competitors and highlighting certain pain points that your customers experience as they go through the claims process. Although the overall score for Hastings Direct is 4.3 out of 5, the score dips significantly for reviewers discussing the claims process. Comparing your review score against competitors gives you the opportunity to understand your own market positioning and how you can best place your effort to make improvements, and provides a valuable opportunity to understand what will have the biggest impact..

Recommendation:

- Make improvements, reduce churn, and drive advocacy by analysing feedback from your customers with a robust competitor analysis.

Using a root cause analysis to identify data-driven improvements to the claims process

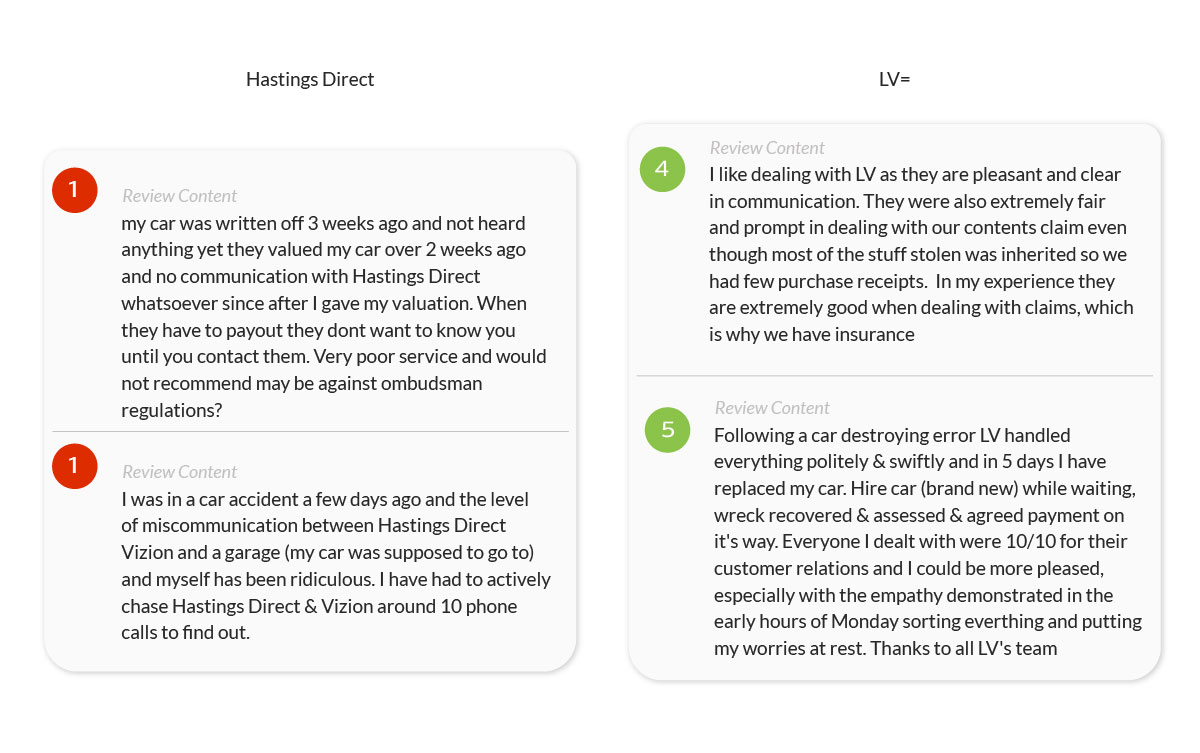

When we compared customer reviews for Hastings Direct and LV=, we discovered that LV= was receiving a higher average score over Hastings Direct. In addition to a score difference, we can explore an individual aspect of the claims journey and see key topics customers are discussing, as well as the score attributed to each of these topics. The chart above demonstrates one of the largest differences between Hastings Direct and LV=: While customers discussing the claims assessment process assign an average score of 3.2 to LV=, the average for Hastings Direct is just 1.9. Delving deeper into the customer data for this category allows us to quickly determine the most common topics the customers were discussing. We found that customers were frustrated with how long it took Hastings Direct to communicate with their customers and suppliers, which delayed the claims process.

Due to their faster response time and efficient communication with customers, LV= are able to complete the claims assessments quicker than what was reported of Hastings Direct, which resulted in LV= having a higher rating score. Access to this type of root-cause driven competitor analysis allows Hastings Direct the opportunity to make improvements that would provide them a competitive advantage in the eyes of potential customers, and provide assurance that improvements made would have a positive impact.

Recommendations:

- Benchmarking and identifying differences in the customer claims process allows companies to take action before customer issues negatively impact your business.

- Segmenting comments to isolate specific paint points allows for a deeper understanding and provides the key to identifying improvements within customer data

If you’re experiencing an unexpected drop in review scores and are struggling to identify the cause, Touchpoint Group's AI Customer Analysis Tool, Ipiphany, will help you discover the key customer pain points and provide insights into how you can boost business performance. If you would like to learn more about leveraging AI customer analytics for your VoC feedback data, get in touch today to chat with our team of experts.